Difference between revisions of "Billing Centre Settings"

(→Invoice Layout) |

|||

| (One intermediate revision by the same user not shown) | |||

| Line 29: | Line 29: | ||

*Printed Header | *Printed Header | ||

| − | Printed Header Header based on information entered | + | Printed Header Header based on information entered. This makes it very easy to update using the settings window. |

| − | This is the default option in | + | This is the default option in EquisoftLive. It will create a textual header based on the information entered in the system. |

*Reserved Header Space | *Reserved Header Space | ||

| Line 41: | Line 41: | ||

For best results please design the image to the dimensions listed below. | For best results please design the image to the dimensions listed below. | ||

All images uploaded will be resized automatically. | All images uploaded will be resized automatically. | ||

| + | The advantage of this type of header is that it can be updated to include any image or layout you wish. It's fully bespoke. | ||

| + | The downside to this type of header is that all changes must be done by uploading an image so this image must be created externally to Equisoft Live. | ||

| + | For help with this please raise a Ticket via the Equisoft Live ticketing system. | ||

Size: 320 x 1072 | Size: 320 x 1072 | ||

Latest revision as of 10:37, 12 May 2021

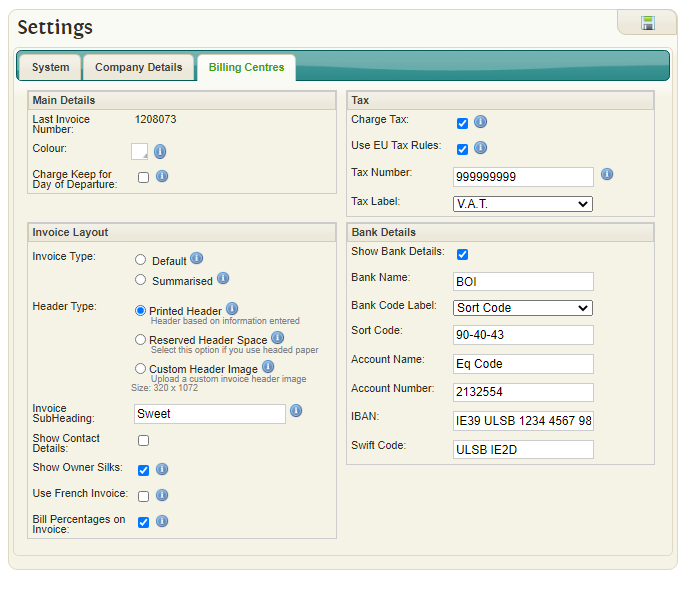

Settings used for invoices are stored in this section.

Contents

Main Details

- Last Invoice Number: The latest number that was used on an invoice.

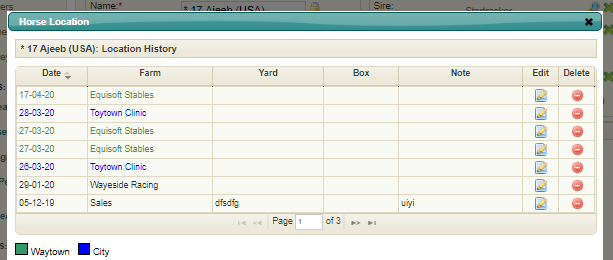

- Colour: The colour to be used on location grids for identifying billing centres.

- Charge Keep for Day of Departure: If this checkbox/flag is set it works as follows: e.g. A horse arrives on 1 July 2020 and leaves on the 12 July 2020. Total days charged is 12, otherwise it will be 11 days TAX code.

Invoice Layout

Invoice Type

Detailed

All items to be charged will be shown from the individual Activity records.

With this setting there are summary options available to you. When creating “Activity Codes”, you can set a code to have a summary bill setting of:

- None – e.g. If 6 wormer records of “Equest” to be charged it shows all 6 items on an invoice.

- Code – In our example, the 6 records are totalled to show a value for “Equest”

- Group – In our example, the 6 records are summarised and shown on an invoice as “Wormer”

Summarised

All records for an Activity Type are totalled and appear as one line on an invoice.

Header Type

- Printed Header

Printed Header Header based on information entered. This makes it very easy to update using the settings window. This is the default option in EquisoftLive. It will create a textual header based on the information entered in the system.

- Reserved Header Space

Reserved Header Space Select this option if you use headed paper This option creates white space at the top of each invoice so that it can be printed onto pre-printed headed paper.

- Custom Header Image

Custom Header Image Upload a custom invoice header image Option allows a custom image to be uploaded and used as the invoice header. For best results please design the image to the dimensions listed below. All images uploaded will be resized automatically. The advantage of this type of header is that it can be updated to include any image or layout you wish. It's fully bespoke. The downside to this type of header is that all changes must be done by uploading an image so this image must be created externally to Equisoft Live. For help with this please raise a Ticket via the Equisoft Live ticketing system. Size: 320 x 1072

Extra Options

- Invoice Subheading: A subheading used on every invoice.

- Show Contact Details: Company Contact details will be shown on invoices

- Show Owner Silks: Will display owner's silks at the top of their invoice if available. These can be set via the owner management section.

- Use French Invoice: Print French version of invoices.

- Bill Percentages on Invoice: Bill Percentages will be displayed on invoices.

Tax

- Charge Tax: Indicates if tax should be used in the system

- Use EU Vat Rules: EU TAX rules will be used when calculating Invoices. When an owner is in an EU country different than that of the main account and has a TAX Number, the TAX code will be overridden with the Exempt TAX code.

- Tax Number: Company's registered Tax Number

- Tax Label: Select variable tax label from the Drop-down list. It will be used throughout system

Bank Details

- Bank Name

- Bank Code Label

- Sort Code

- Account Name

- Account Number

- IBAN

- Swift Code