Settings Billing Lists

Contents

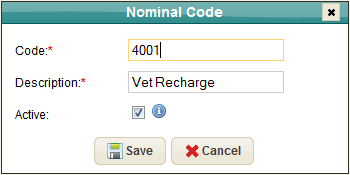

Nominal Codes

Nominal codes are a means of analysing sales revenues raised in EquisoftLive under different Book-keeping headings. They are compulsory for use with the Ledger Module.

For example they will enable you to sum all your vet recharges to one total and for it to be reflected in the chart of accounts.

Bill Categories

Customise a list of Billing categories (frequency of charging) to suit your charging needs.

Typically the values are: Monthly, Departure, On demand, etc.

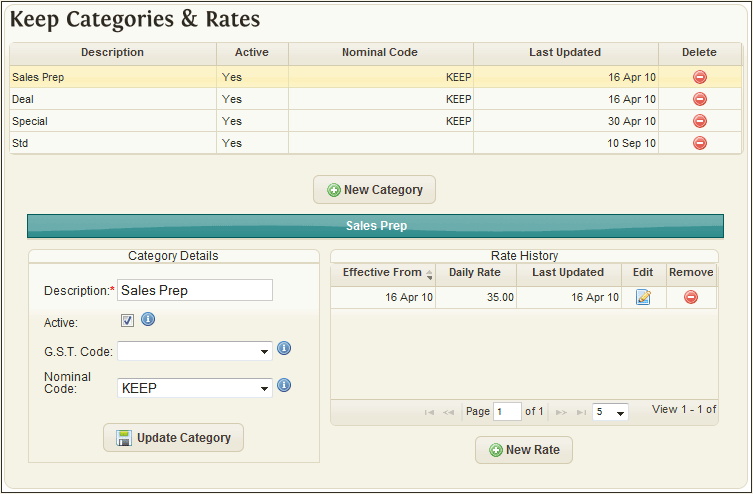

Keep Categories & Rates

Use the window to create a customised list of keep/boarding rates per day. Within each charge category the system allows you to maintain daily rates based on an effective date in each case.

Category Details

- Description: (required) Description to be used for the Keep Category throughout the system.

- Active: Indicate whether the Keep Category is in use.

- Tax Code: The Tax Rate used when charging the Keep Rate for this Keep Category.

- Nominal Code: The Nominal Code used for analysing the charges for the Keep Category.

An individual Keep Category can then be attached to each Horse record in the system in the Billing Section.

For example, you could have a number of horses on a “special” rate of 35.00 per day and increasing this to 40.00 per day on the 30th June.

There is no need to touch the horse record to implement the rate change - it is updated on a global basis.

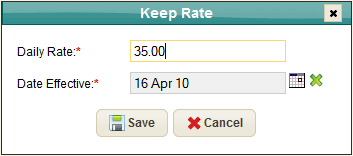

Users can maintain a history of Rate changes for a Keep Category, which is displayed in the snapshot in the lower right corner of the Keep Categories & Rates screen.

Existing rate changes can be modified to amend the Daily Rate or the Date Effective, or a new rate change can be added by clicking the 'New Rate' button.

Very Important Note

When adding a new Rate make sure the "Effective From" value for the first item has a date which occurs BEFORE it's in use on any horse record.

When in doubt please set this rate to 1st January of the previous year.

Failure to set an adequate first "Effective From" date could result in a horse not being charged keep/training fees for the period that keep rate was assigned to them.

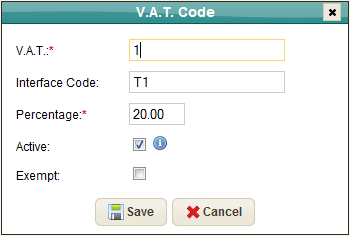

Tax Rates

This window is used to create a customised list of tax rates to be used throughout the system.

For each code, enter a %, whether the code denotes “exempt” status and an Interface code.

The Interface code is only needed if you are using a 3rd party accounts system.

Changing Tax Rates

If a tax rate changes (for example, In Ireland the standard VAT rate was changed from 23% to 21% for a six month period beginning 1st September 2020) then the following steps need to be carried out.

- Run the Keep Extract and Proof List up the end of the last billing period. In the example above the user would run their Keep Invoices up until the 31st August 2020.

- Once the invoice procedure has been completed and the invoices committed to history then the Tax rate can be changed as described above.

The Tax rate is only looked up when the proof list is being generated so the user can continue to enter vet and farrier work as normal.